„Yes, you didn’t order it but it is very good!“

The Milanese Cheese seller smiled at me from behind his cheese stand and didn’t really understand, why i wasn’t amused about the extra „Fior di Latte“ he snuck into my cheese selection. Fior di Latte is a wonderful cheese, similar to Mozzarella, but much creamier inside. I love Fior di Latte. But I also love to decide for myself, if I want to buy it, especially when it doubles the amount I have to pay.

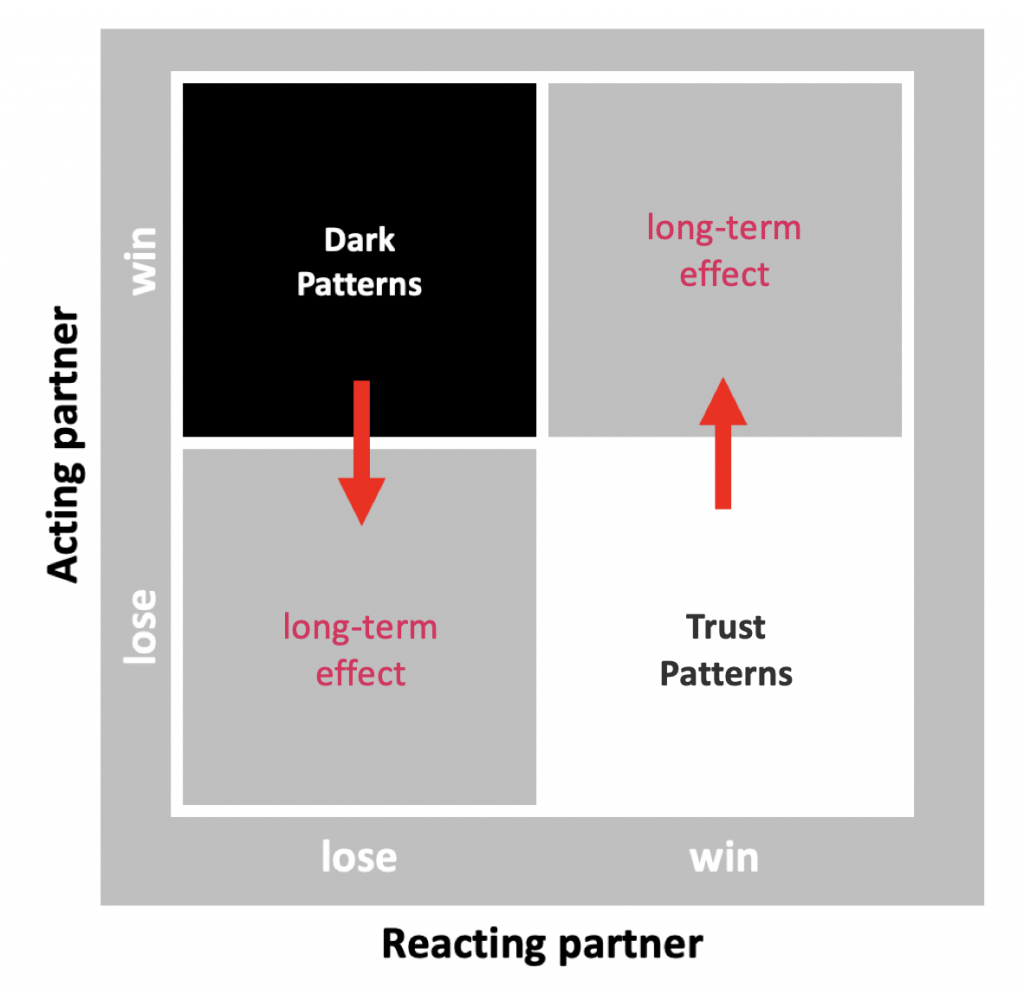

The „Sneak into basket“ trick he applied is one of the so called „dark patterns“ used in eCommerce nowadays. Dark patterns range from „Hidden Costs“ to „Price Comparison Prevention“. All these tricks have in common, that they generate an unfair advantage in a business relationship. One could say dark patterns are the saving belt for Product Managers and Marketeers with over ambitious short-term sales goals. I guess with this simple trick the cheese seller sold quite a bit of Fior di Latte to new customers.

What he didn’t know was that I lived just around the corner for another 4 years and yes ever since then I quit my „business relationship“ with him and bought my cheese at the market stand right next to him. Business relationships evolve quite similar human relationships. Our relationships are not re-evaluated from scratch everyday. It is to a very high extent set at the initial moments of interaction (the introduction phase) and re-evaluated in moments of conflicts with the preset expectations. Black patterns, especially applied at the beginning of a relationship, define it to be based on distrust and low engagement.

The future of business is based on longterm relationships

We are in the business era of „everything as a service“ – meaning next to everything we used to buy is now available as a digitalized pay-per-use equivalent. And if it isn’t yet it will be tomorrow. Angela Merkel, the German chancellor, just recently predicted, that “everything which can be digitalized will be digitalized in the near future”. EaaS comes with an unbeatable set of competitive advantages in comparison to leasing or selling based business models. But they have one weak spot: EaaS based businesses derive little earnings or even losses in the beginning of the customer relationship. Every new customer produces initial onboarding efforts and running costs increasing the payout time for these relationship based businesses up to years. And usually these business models not only make the purchase decision much easier, but also the decision to switch the service partner (sell your car and buy a new one versus changing from car2go to drivenow). Robbie Kellman Baxter discusses the underlying opportunities and challenges of this business model in detail in her book „Membership Economy“.

The key success factor of EaaS business cases to break even are engaged customers.

It’s the level of engagement (activation, recommendation and retention) of their customers which makes EaaS profitable and this engagement is highly dependent on the quality of the relationship companies have with their members.

Just recently at the digital agency USEEDS°, we calculated the business opportunities in a fully digitalized wealth management service based on a „pay-per-use“ purchase model. For the customer this service is a highly attractive alternative to classical consulting fee based models. But for the bank the beauty of a scalable fully digital system only flourishes, if tens of thousands of customers actively use the service for years to reach the Return on Investment. The core lever of successful relationship businesses is the long-term loyalty and engagement of customers. There is no place for dark patterns in this business model.

We need patterns to boost long-term relationships

The success of relationship based business models is highly dependent on the quality of relationship they set in the introductory stage. All follow-up attempts to influence the relationship with Customer Loyalty or Customer Engagement programs are less efficient and effective. We analyzed 300 companies in their approach to set a positive relationship at the moments of truth (moments of introduction, trouble or expectation conflicts) and discovered a set of patterns which could be applied to any business. (we will present and discuss the patterns in future articles at trustpatterns.org )

The longterm business advantage in Trust patterns

Patterns trading an initial disadvantage for the company for long term Customer Loyalty and Engagement are the opposite of dark patterns – so we call these patterns Trust patterns. Trust patterns create an initial „unfair advantage“ for the customer (the reacting partner) not the company (the acting partner). Trust patterns foster the quality of relationship towards that feeling of loyalty and trust – a feeling of belonging. They are not magic. nor manipulative. Trust patterns suggest an initial investment to set positive, long-lasting relationships, in which the investment generates returns in time.

We are not talking business romantics here

Without a solid business case next to a great purpose vision and attitude, any endeavor is damned to vanish. Trust patterns in business are an extremely valuable building block in membership business which only derives the expected long-term revenue streams and return on investments, if you clients a held in a positive AND active relationship. And membership business is a mega trend around industries. According to a 2018 study* with 1200 teenagers in Germany (12 – 19 years old) , the amount of netflix users doubled within one year to 47% market penetration. Spotify grew by 28% from Q3 2017 to Q3 2018 toward 190 Million users worldwide. The ownership model will still be around, but undeniably, membership business and the „everything as a service“ mantra in digitalization are the new business paradigm.

Trust patterns define the necessary sustainable and profitable ways to make long-term business success happen AND spread the idea of trustworthy and fair relationships in our society.

*by 2018 JIM-Studie 2018 des Medienpädagogischen Forschungsverbunds Südwest