After 35 years working at Boeing, Dennis Muilenburg stepped back as it’s Chairman on the 23rd of December 2019, just one week after Boeing announced the complete production stop of the Boeing 737 max. This didn’t come as a surprise, as the Boeing 737 max was expected to be the next Cash Cow, accounting for three quarters of Boeings net income streams in civil airplane production with more than 5.000 preorders. There were no kind words and congratulations for him as usually when a chairman steps back. Boeing distanced itself from Muilenburg announcing that it would be necessary now to repair the trust in Boeing.

Muilenburg leaves a company in deep crisis. For decades Boeing, one of the biggest US companies in the manufacturing industry, the biggest US exporter and one of the biggest US employers with more than 150.000 employees was leading the head-to-head race with it’s European rival AIRBUS on civil airplane production. In 2018 Boeing won the race again with 806 delivered machines versus 800 machines at Airbus. In 2019 the head-to-head race came to an abrupt ending. AIRBUS increased it’s amount of delivered machines up to 863 but Boeing left the race with a total of only 296 machines! In 2019 they lost two third of their total expected delivered planes! Even loyal US clients like American Airways and United Airlines switched from Boeing to AIRBUS. United Airlines for instance ordered 50 AIRBUS A321XLR – the equivalent AIRBUS product to a Boeing 737max – worth around 6 Billion US Dollars. Boeing lost the race. Boeing’s reaction? It announces to repair trust towards their clients and institutions. If you need a „return-of-investment“ example for trust management and trust design. Here it is.

The ROI of a trust based organization

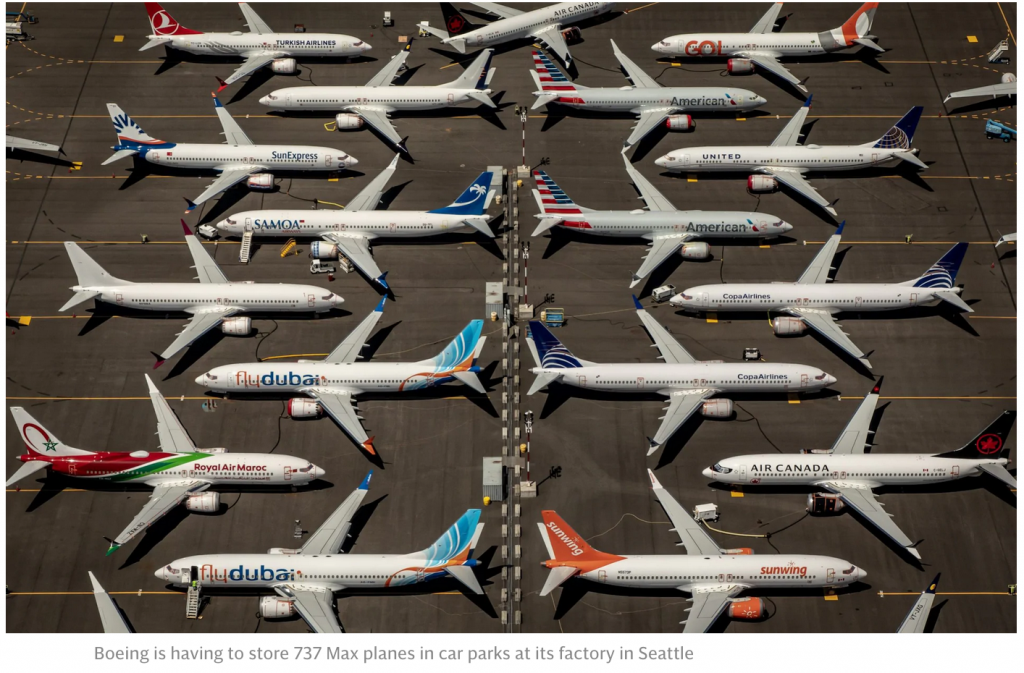

Due to lost trust, Boeing lost two third of their market and will need years to join the race with AIRBUS again. There are more than 400 Boeing 737max worth an estimated 40 billion $ sitting on employee parking sites not to be delivered until 2021, which costs an estimated 1 billion $ per month. Additionally they expect the total of contract fines due to delayed delivery of machines to reach around 10 billion $ and even worse: the development of a new alternative for the „New Middle of the Market“, called 797 which could compete against the Airbus A321XLR is stopped, due to the expensive efforts to repair the 737 max disaster. (The 797 would be a replacement for the Boeing 757 which was produced until 2005 – 15 years ago.) Trustworthiness is a longterm investment and it pays off. AIRBUS is completely sold out until 2024.

Or was it just bad luck?

For Muilenburg, it wasn’t a lack of trustworthiness, it was just bad luck – an „unlucky combination of unexpected events“ leading to 346 dead passengers and crew members. Here is the thing: The Boeing 737max crashes near the Coast of Java and in Addis Abeba weren’t the first deadly 737 crashes. Since 1967 a total of 210 Boeing 737 crashed and 5.010 people died – without harm to the Boeing market value and order book. This case was different. This case was about lost trustworthiness towards all stakeholders involved. And as a consequence, the Federal Aviation Administration decided to check every single of the 400 planes on the parking sites once a solution for the technical issues is accepted. The FAA switched from a trust based relationship with Boeing, in which the major part of testing was not proceeded by FAA staff but Boeing staff to checking every single plane. A binding promise of Boeing that only planes with the new safety standards built in will be handed over to airlines didn’t suffice – anymore.

Or maybe a case of bad PR consulting?

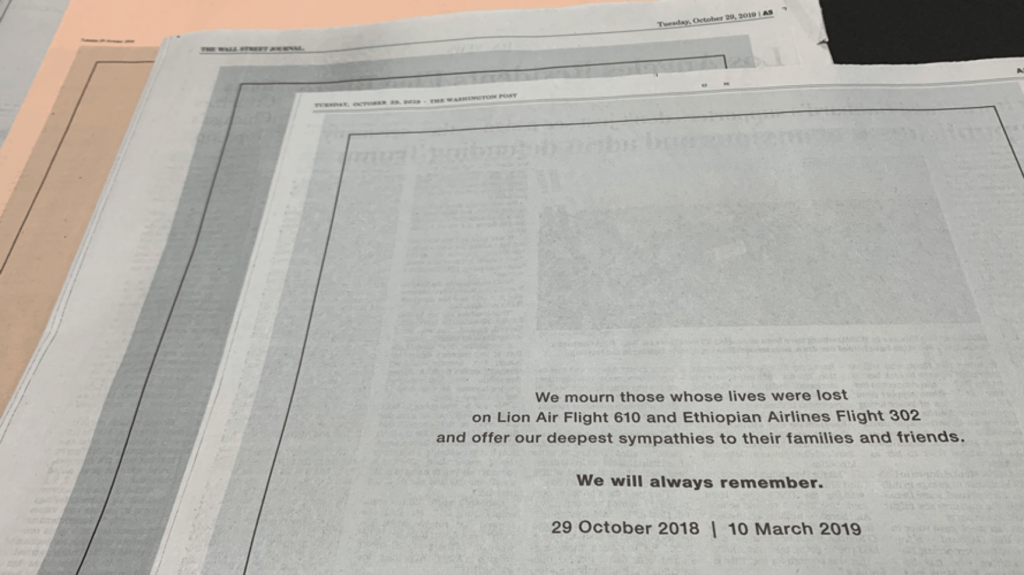

Or was it just a case of bad Public Relationship Management? Didn’t Muilenburg and his Management Team show enough grief? Should the full page Financial Times announcement stating „deepest sympathies” have been double the size? Should they have apologized? When trust is in question, the right communication does make a difference. But to repair trust, you need to act, to proof that your competence and intentions are as expected.

Promise doesn’t work when trust is in question.

Proof does! Take Johnson & Johnson’s former CEO James Burke*. In 1982 a similar crisis happened to Johnson and Johnson. Their cash cow, Tylenol, which accounted for 17% of Johnson & Johnson’s net income was laced with cyanide most probably by a blackmailer and 7 people died taking it. Burke immediately reacted quite differently than Muilenburg. He spent about 100 Million Dollars in proofing, that Johnson and Johnson does care about it’s customers. He pulled Tylenol from the shelves, stopped advertising it, tested 8 million pills by the end of the first week of the recall, offered customers coupons to make up for the bottles they might have to throw away, and had the company design a new tamper-evident triple seal, which was adopted by other pharmaceutical companies. Within months, Johnson and Johnson’s stock regained its previous heights. He wasn’t alone – although there was criticism the organization surrounding him supported his way of dealing with the crisis.

The root cause is not a person but the culture

Muilenburg failed in managing the crisis and given the devastating impact it is more than understandable that he needed to step down. But he isn’t responsible for most of the decisions leading to a plane with deadly malfunctions. The decision to save costs by pimping up the old 737 model instead of redesigning a new model from scratch was made way before he became chairman in 2015. As a matter of fact, Boeings loss of trustworthiness started way before and it infiltrated the whole organization. Take the Amsterdam accident in 2009, when Muilenburg was still working in the military division of Boeing. On the 25th of February 2009 flight TK1951 – a Boeing 737 – 800 (the predecessor of the 737 max) – crashed shortly before landing at Schiphol Airport, Amsterdam and nine people were killed. An expert study that sharply criticized Boeing was never published by the Dutch safety authorities, and its key findings were either excluded or played down in their accident report. It took the Dutch Safety Board, which had commissioned the study, more than 10 years to reverse course and publish the study — a day after The New York Times detailed the findings In January 2020. The Times’s review of evidence from the accident showed the study’s conclusions were relevant to investigations into the Boeing 737 max crashes that killed 346. It turned out, that the Dutch removed or minimized criticisms of Boeing after pushback from a team of Americans that included Boeing and federal safety officials.

Boeing – a lack of trust throughout the organization

There were at least three proven letters of employees urging the upper management to investigate and redesign the aircraft. What happened to the engineers writing these desperate notes to their managers? These guys would be the connect back to when Boeing had an engineering heart – Nurdy but full of compassion to design safe airplanes – the 90s when Boeing was making a good 6% margin with good products. 6% margin wasn’t enough the management back then decided and turned the purpose of Boeing upside down towards a company with one main task: increasing market value (which also came in handy, as the upper management of Boeing is paid out to a large extend in Boeing shares). They defined the new parameters of what success meant for the organization and these parameters were solely about the „now“. A situation we know from people who consume too much alcohol. The long term impact of decisions fades out. The short term impact is key. Today there is no trust retainer left for Boeing.

Trust is a company asset

Boeing had the competence to design a safe and economic aircraft but the intentions got corrupted. It wasn’t about longterm relationships any more. The upper management decided to put short term profit before longterm trust. Now that we can look back, one could say they decided to sell the family silver as dearly as possible to maximize profits. That family silver of Boeing was the trust their business partners invested, worth many billion of US Dollars – a key company asset which should be part of P&Ls, shareholder communication and M&A assessments.

What about your organization?

Do you think a scenario like this could happen in your organization? How can you be sure? Do you know of any KPI or measurement used at your organization to have a clear view on how much your organization runs on trust?

*I found this story in the Harvard Business Review on trust by Sandra J. Sucher, a professor of management practice: https://hbr.org/cover-story/2019/07/the-trust-crisis, the detailed story can be found here: https://hbsp.harvard.edu/product/390030-PDF-ENG

Also published on Medium.