Kunden müssen sich für oder gegen eine Kundenbeziehung entscheiden, bevor sie die Konsequenzen ihrer Entscheidung erlebt haben. Deshalb ist die antizipierte Kundenbeziehung zentral.

Im Moment des Abschlusses entscheiden sich Kunden nicht nur für oder gegen ein Angebot. Sie sehen eine Kundenbeziehung die sie je nach Branche mehr oder weniger leicht wieder beenden können. Ist das Auto einmal geleast oder das Girokonto einmal eröffnet ist das nur mit hohem Aufwand rückgängig zu machen.

Bei der Abschlussentscheidung berücksichtigen Kunden daher nicht nur die offensichtlichen Mehrwerte des Angebotenen und derem Preis, sondern auch die möglichen Risiken und Chancen in der gesamten antizipierten Kundenbeziehung. Was ist wenn ich das Leasing Auto zurück geben muß? Werden die in naher Zukunft die Gebühren erhöhen? Fragen wie diese „gehen dem Kunden durch den Kopf“ wenn sie sich entscheiden und erklären was Wirtschaftspsychologen fasziniert „Inertia“ nennen – eine schlaue Reaktion der Kunden wenn sie die Risiken der antizipierten Kundenbeziehung als zu hoch betrachten, bzw. nicht absehen können.

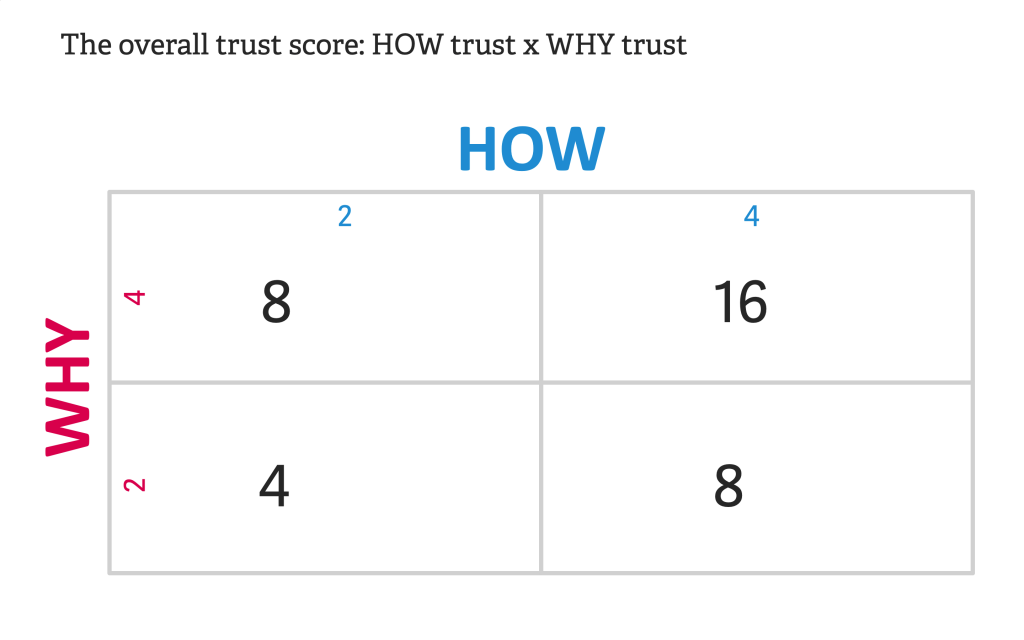

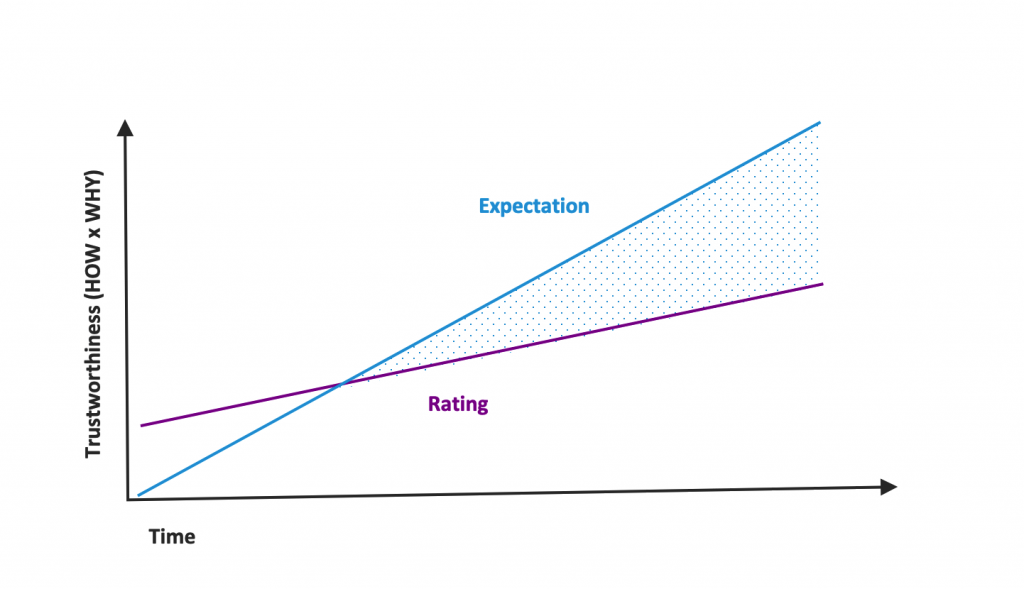

Die Einschätzung von Risiken und Chancen einer antizipierten Kundenbeziehung werden in den etablierten Business Design Frameworks wenig beachtet. Risiken (und Chancen) ergeben sich aus der Bewertung imaginativer zukünftiger Ereignisse in zwei Faktoren die wir aus dem Risiko Management kennen. Der erste Faktor bezieht sich auf die eingeschätzte Wirkung des Ereignisses falls es eintreffen würde (Flug ist stark verspätet vs. Gepäck wird vermisst). Der zweite Faktor ist die eingeschätzte Eintrittswahrscheinlichkeit der Ereignisse (also dem Vertrauen, dass in der entsprechenden Kundenbeziehung positive Ereignisse eintreten und negative Ereignisse nicht eintreten werden). Beide Faktoren kombiniert definieren wie entscheidend ein Risiko oder eine Chance bewertet wird.

Das Trust by Design Framework bietet geeignete Methoden um die kundenseitige Einschätzung der entscheidungsleitenden Risiken einer Kundenbeziehung zu reduzieren und die erhofften Chancen aus Kundensicht zu stärken.

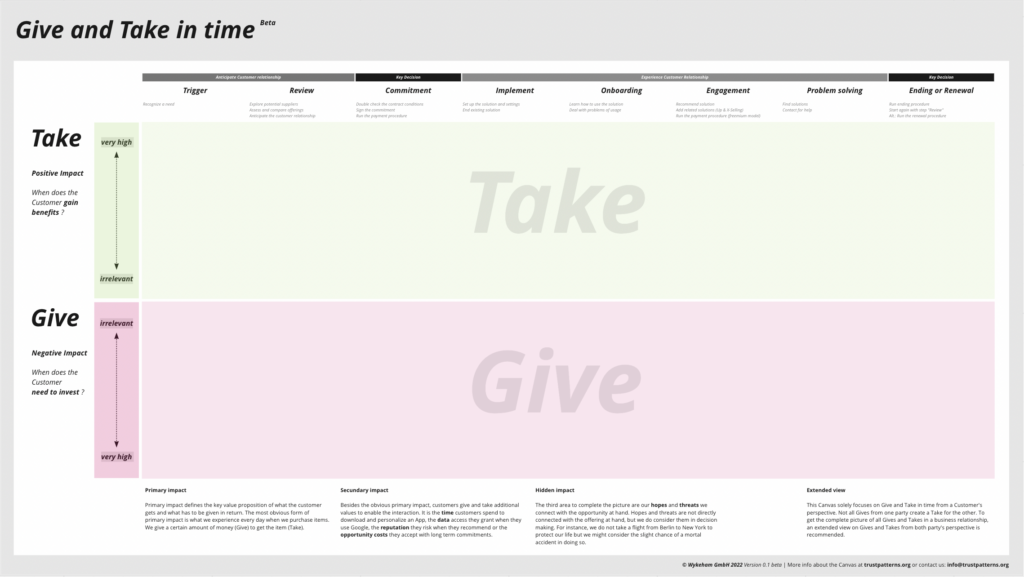

Mit der „Give and Take in Time“ Methode werden die positiven und negativen Ereignisse entlang einer antizipierten Kundenbeziehung erfasst in denen Kunden entscheidungskritische Risiken und Chancen sehen.

Darauf aufbauend erlaubt die Methode „Antizipierte Risiken und Chancen in der Kundenbeziehung“ diese wahrgenommenen Risiken und Chancen in den Ereignissen zu bewerten und damit vergleichbar zu machen.

Das Ergebnis ist eine gewertete Liste der wahrgenommenen Risiken und Chancen einer Kundenbeziehung die Kunden bei der Entscheidungsfindung berücksichtigen.

Eine ideale Basis um mit geeigneten Mitteln die antizipierte Wirkung und Eintrittswahrscheinlichkeit der wichtigsten Risiken und Chancen positiv zu verändern.

1. Give and Take in time

Im ersten Schritt wird ein Gesamtbild der antizipierten Kundenbeziehung erfasst. Hilfreich ist dabei eine Methode, die ich „Give and Take in time” nenne. Mit „Give and Take in Time“ machen wir uns ein Bild aller antizipierten Ereignisse einer Kundenbeziehung. Ereignisse die Kunden berücksichtigen wenn sie verstehen wollen ob sich eine Kundenbeziehung für sie insgesamt lohnt – ob das was man bekommt (Take) den Aufwand (Give) rechtfertigt.

Wir können diese Ereignisse auf Basis einer qualitativen Kundenbefragung erheben (oder wenn es schnell gehen soll in einem Workshop sammeln). Die erwarteten positiven und negativen Ereignisse in der antizipierten Kundenbeziehungen werden dann im Zeitverlauf als Geben oder Nehmen Ereignisse gemappt.

Um ein möglichst vollständiges Spektrum an Ereignissen zu erfassen hilft es, erst den Zeitverlauf der gesamten Kundenbeziehung als Schritte einer Customer Journey zu skizzieren (oder aus schon bestehenden Customer Journey Modellen zu übernehmen). Im Gegensatz zur sonst üblichen Customer Journey Modellierung beschäftigen wir uns dann aber nicht mit der Erlebnisqualität entlang der Customer Journey Schritte, sondern sammeln lediglich die antizipierten negativen und positiven Ereignisse (Gives and Takes) entlang der Journey.

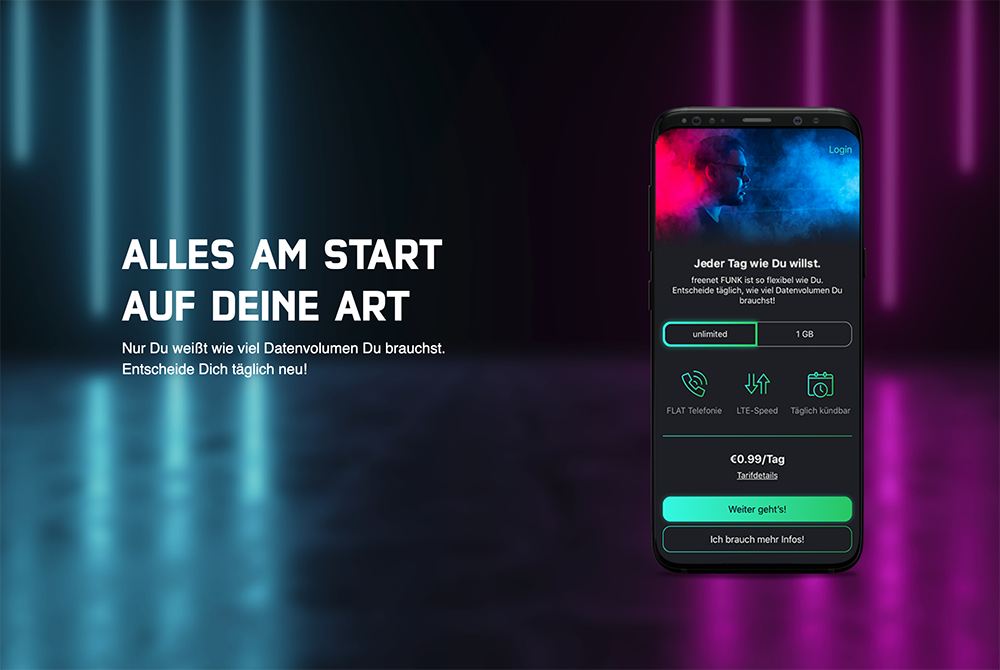

Die Ereignisse beinhalten natürlich die primären Ereignisse die ein Angebot ausmachen wie das Geld (Give) das der Kunde für ein Auto (Take) zahlen wird. Es werden aber auch sekundäre Ereignisse berücksichtigt die vielleicht dem Unternehmen keinen direkten Mehrwert liefern, die aber dennoch vom Kunden investiert werden müssen. insbesondere Zeit und Daten spielen hier eine große Rolle. (Das Trust by Design Framework beinhaltet ein ausführliches „Cheat sheet“ derwichtigsten Werte die sekundär eine Rolle spielen können.)

Zeit

Die Zeit die ein Kunde aufbringen muss um sich mit dem Angebot zu beschäftigen (Die Vielzahl an Features verstehen und vergleichen), das Angebot abzuschließen (die ewige Antragsstrecke und die 90 Seiten AGB), den Status Quo zu beenden (Kündigungsschreiben etc.) das neue zu implementieren (Die Mitteilung der neuen Kontonummer, die Änderung der Lastschriften, die Settings) und kennenzulernen (das neue TAN Verfahren, die neue Navigation etc.)

Daten

Die persönlichen Daten zur Person, Daten zu Bezahlungsmitteln (z.B. die Angabe der Kreditkartendetails obwohl man das Angebot erstmal umsonst testen kann) aber auch Identifikationsmittel (die Personalausweisnummer oder das Identverfahren das durchlaufen werden muss).

Ausserdem lohnt es sich auch die versteckten Ereignisse zu berücksichtigt. Extreme Ereignisse die nicht im direkten Zusammenhang mit dem Angebot stehen aber in der Risikobetrachtung eine große Rolle spielen können wie der mögliche Flugzeugabsturz beim fliegen, das Ausbleiben von erwarteten primären Werten (z.B. Kunde hat zwar gezahlt, aber das Auto wird nicht geliefert) oder der Datenmissbrauch bei der Online Bezahlung.

Das resultierende Modell aus “Gives und Takes in time” zeigt ein komplettes Bild der entscheidungstreibenden Ereignisse, die ein Kunde berücksichtigt bevor er sich entscheidet.

Give and Take in time im Vergleich zu klassischen Value Proposition Methoden

Give and Take in time erweitert die klassische Value Proposition Betrachtung durch zwei entscheidende Aspekte der Kundenbeziehung.

In Formaten wie dem Value Proposition Canvas wird ausschließlich das „Take“ in der Kundenbeziehung betrachtet. Was braucht der Kunde? und was können wir ihm anbieten? Die Kundenbeziehung besteht aber, wie jede Interaktion, aus gegenseitigem Geben und Nehmen. Wenn wir ein vollständiges Bild der erwarteten Kundenbeziehung zeichnen wollen ist es daher wichtig beide Aspekte – Give and Take – zu betrachten. Dazu kommt die Modellierung in Zeit. In der antizipierten Kundenbeziehung macht es einen großen Unterschied, ob der Kunde stark in Vorleistung gehen muss (Give) bevor er eine Gegenleistung erlebt (Take) oder andersrum. Das Value Proposition Canvas spart auch diesen wichtigen Faktor aus und sammelt die „Takes“ in einer zeitunabhängigen Liste.

Nutzen

- Zeigt ein komplettes Bild der erwarteten positiven und negativen Aspekte einer Kundenbeziehung aus Kundensicht auf

- Hilft bei der Ableitung der relevantesten Entscheidungstreiber in der antizipierten Kundenbeziehung

- Grundlage für die Quantifizierung der antizipierten Risiken und Chancen in einer Kundenbeziehung

2. Antizipierte Risiken und Chancen in der Kundenbeziehung

Die quantitative Analyse der aus Kundensicht erwarteten positiven und negativen Ereignisse in einer Kundenbeziehung zeigt, wo wir ansetzen müssen.

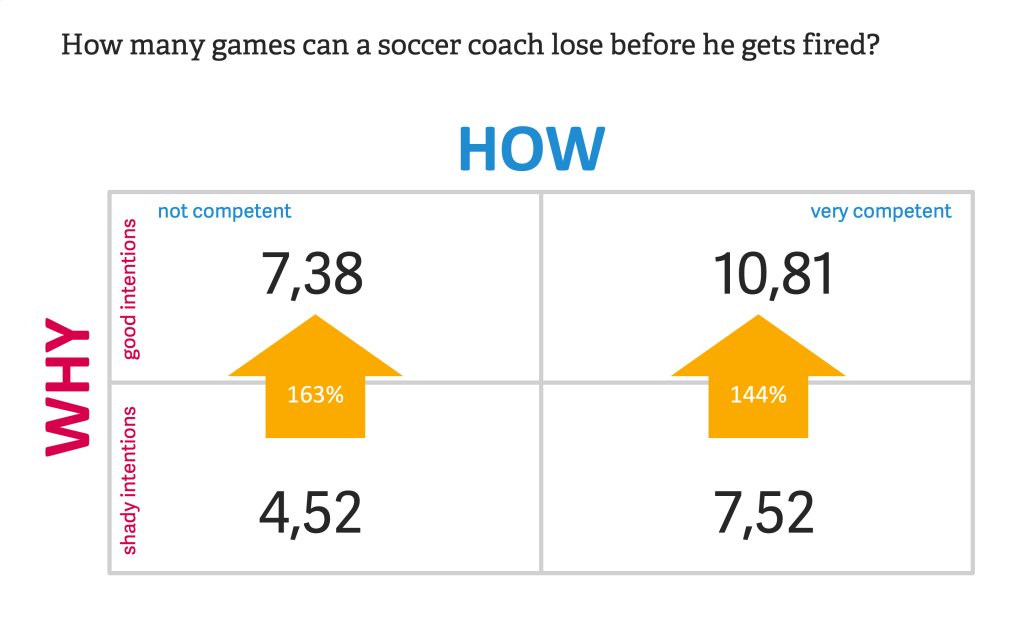

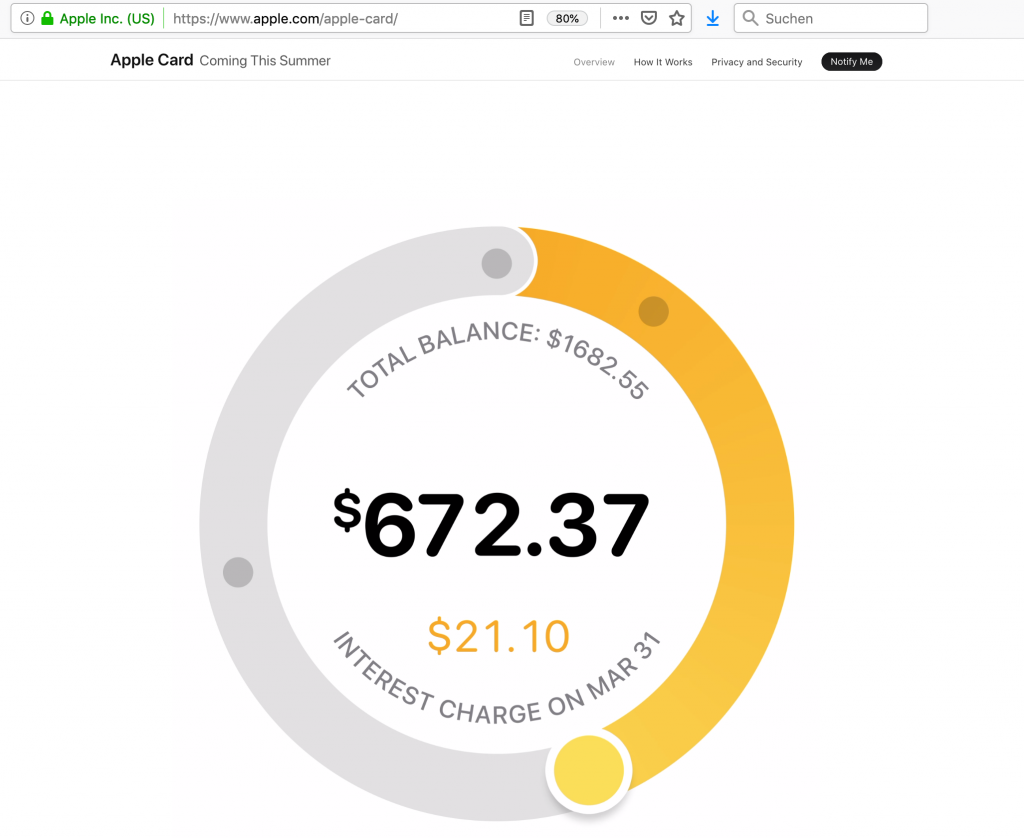

Give and take in time bietet einen guten Überblick der antizipierten Ereignisse in einer Kundenbeziehung. Aber natürlich ist die Wichtigkeit dieser Ereignisse für Kunden sehr unterschiedlich. Das bekannte Sprichwort „besser ein Spatz in der Hand als eine Taube auf dem Dach“ beschreibt die zwei Faktoren, die bei der Bewertung der möglichen Ereignisse genutzt werden – die Wirkung (Spatz vs. Taube) und deren Eintrittswahrscheinlichkeit (Hand vs. Dach). In dieser Betrachtung relativiert sich der Marktvorteil einer besseren Value Proposition (einer besseren erwarteten Wirkung) – Kunden stellen ihr eine Eintrittswahrscheinlichkeit gegenüber und entscheiden unter Berücksichtigung beider Faktoren.

Im Risikomanagement beschreiben genau diese beiden Faktoren was wir Risiken und Chancen nennen. Und genau die betrachten Kunden wenn sie sich entscheiden. In der Entscheidungsfindung stellen Kunden dem versprochener Mehrwert (der Value proposition) und erwartetem Aufwand das Vertrauen gegenüber dass sich Mehrwert und Aufwand auch wie erwartet materialisieren. Unternehmen können versprechen was sie wollen. Am Ende macht der Kunde sich ein Bild der antizipierten Mehrwerte und Aufwände und wie stark sie darauf vertrauen können dass beide auch tatsächlich in der Form stattfinden werden. Dann entscheidet er.

Die Methode Antizipierte Risiken und Chancen in der Kundenbeziehung hilft dieses Bild des Kunden nachzuvollziehen und die wichtigsten Risiken und Chancen in der Entscheidungsfindung zu identifizieren.

Idealerweise werden die Risiken und Chancen mittels einer quantitativen Umfrage erhoben. Dabei werden die möglichen antizipierten Ereignisse aus „Give and take in Time“ vom Kunden nach Wirkung und Eintrittswahrscheinlichkeit bewertet. Von Vorteil ist es wenn man dabei die erwartete Wirkung und Eintrittswahrscheinlichkeit des eigenen Angebots mit Wettbewerbern oder einer generellen Branche vergleicht.

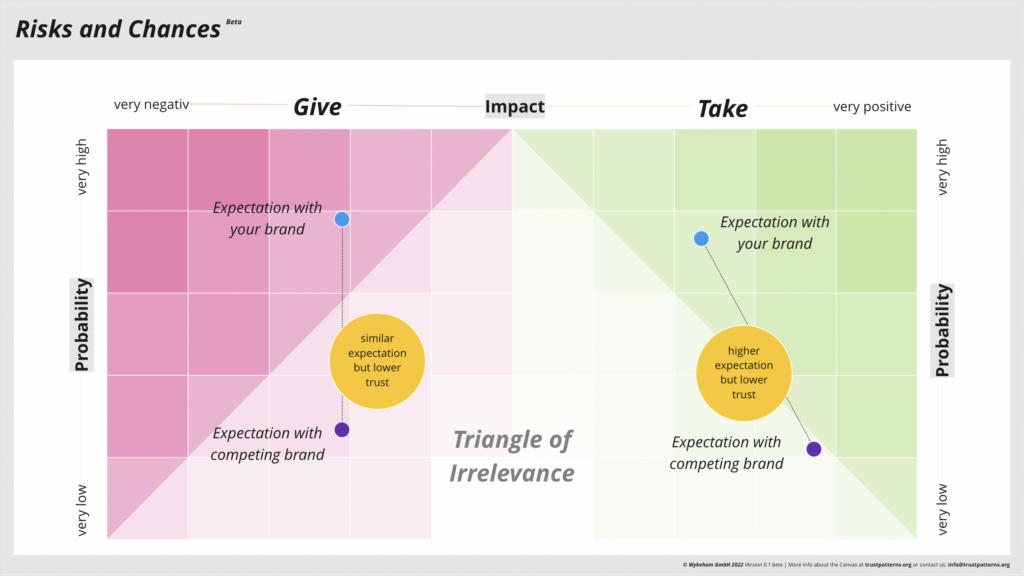

Das Ergebnis lässt sich in der Antizipierte Risiken und Chancen Matrix gut visualisieren. Auf der X-Achse wird die Wirkung in einem Kontinuum von extrem negativ über neutral zu extrem positiv dargestellt. Die Y-Achse zeigt die antizipierte Eintrittswahrscheinlichkeit des Ereignisses von absolut wahrscheinlich (oben) bis absolut unwahrscheinlich (unten). (Die Eintrittswahrscheinlichkeit ist ein Abbild des Vertrauen, das Kunden im jeweiligen Ereignis gegenüber dem Unternehmen haben.)

Die daraus entstehende Fläche kann grob in drei Bereiche eingeteilt werden:

Im linken oberen Dreieck finden wir die Risiken – Ereignisse die als negativ empfunden werden und deren Eintrittswahrscheinlichkeit relevant ist.

Im rechten oberen Dreieck sind die Chancen – Ereignisse die als positiv empfunden werden und deren Eintrittswahrscheinlichkeit relevant ist.

Das große Dreieck im unteren Bereich nenne ich „triangle of irrelevance“. Es beinhaltet alle Ereignisse die für Kunden irrelevant sind, weil ihre Wirkung und / oder ihre Eintrittswahrscheinlichkeit als zu gering eingeschätzt werden.

Nutzen

- macht antizipierte Kundenerlebnisse vergleichbar

- zeigt Gaps und Handlungsoptionen zwischen Wettbewerbern auf

- Zeigt die Aspekte einer Kundenbeziehung auf, bei denen wir einen überdurchschnittlichen Einfluss auf die Entscheidungsfindung haben können

Ergebnis: ein Gesamtbild der entscheidungsrelevanten Risiken und Chancen einer antizipierten Kundenbeziehung

Alle antizipierten Ereignisse in der Matrix verortet ergeben ein Gesamtbild der antizipierten Risiken und Chancen aus Kundensicht – für uns und für die zum Vergleich getesteten Wettbewerber. Auf Basis dieser Modellierung läßt sich nachvollziehen welche antizipierten Ereignisse besonders entscheidungsrelevant sind. Im nächsten Schritt können diese Ergebnisse genutzt werden, um die entscheidungsrelevantesten Ereignisse zu identifizieren und mit geeigneten Maßnahmen zu optimieren.

Messung der Relevanz von Risiken und Chancen – die Vektorenbetrachtung

In der Matrix lässt sich die Relevanz von Risiken und Chancen leicht erkennen. Um so näher ein Ereignispunkt am oberen linken (bei Risiken) oder oberen rechten (bei Chancen) Eckpunkt ist, desto höher ist die Kombination aus Wirkung und Eintrittswahrscheinlichkeit. Der Abstand des Ereignispunkts zum Eckpunkt ist also ein guter Indikator um die Relevanz des Ereignisses zu schätzen.

Im Detail lassen sich die absolute Position der Ereignispunkte aber auch der Abstand (also die Vektoren Längen) zu Benchmarks oder spezifischen Wettbewerbern für die Bewertung der Gives and Takes und der späteren Erfolgsmessung der getroffenen Maßnahmen nutzen.

Strategien um die antizipierte Kundenbeziehung zu stärken – zwei Wege zum Ziel

Generell geht es bei der Optimierung der antizipierten Kundenbeziehung darum durch geeignete Maßnahmen antizipierte Risiken in das „triangle of irrelevance“ und antizipierte Chancen aus dem “triangle of irrelevance“ zu bewegen.

Dafür stehen uns zwei Arten von Maßnahmen zur Verfügung. Wir können – mit etablierten Methoden des Value proposition Design – die antizipierte Wirkung verbessern und kommunizieren (also den Ereignispunkt nach rechts bewegen). Wir können aber den selben Effekt erzielen, wenn wir die antizipierte Eintrittswahrscheinlichkeit des Ereignisses bei Risiken nach unten und bei Chancen nach oben bewegen.

Oftmals ist der zweite Weg bedeutend effizienter (mehr Wirkung ist meistens mit mehr Aufwand verbunden) und effektiver (mehr Wirkung ist schnell vom Wettbewerb kopiert und wird dann einfach zum neuen Standard).

Ausblick

In den folgenden Beiträgen werde ich auf folgende Themen im Trust by Design Framework eingehen:

- Trust by Design Massnahmen

wie man mit Trust by Design Maßnahmen identifiziert um die Risiken und Chancen einer Kundenbeziehung zu optimieren - Trust by Design für Bestandskunden

Risiken und Chancen spielen auch für Bestandskunden eine große Rolle. Während es bei Neukunden um die antizipierte Kundenbeziehung geht, spielt bei Bestandskunden die erlebte Kundenbeziehung eine große Rolle wenn wir Vertrauen vertiefen und wieder herstellen wollen. Trust by Design hat hier einen signifikanten Einfluss auf die Kundenzufriedenheit, das X-Selling Potential und die Kundenbindung - Vertrauen in Kunden

Nicht nur das Vertrauen von Kunden wirkt positiv auf die Kundenbeziehung. Auch das Vertrauen in Kunden kann dafür genutzt werden um besonders vertrauenswürdigen Kundensegmenten gezielt Mehrwerte zu bieten. - Trust by Design Governance

Im letzten Beitrag teile ich Erfahrungswerte und Ansätze um Trust by Design als Management Disziplin in Organisationen zu verankern.