Have you ever experienced that sudden frustration of queuing in a long line in the super-market and noticing that you had forgotten your money? Upset at your own forgetfulness, you think of the hassle you will have to go through such as returning all the items in your basket to their shelf (or hiding them somewhere…?), walking back home and up the stairs in a hurry, fetching your purse (or smartphone or cards) then returning to the supermarket after having to phone your friends to tell them you will be late You would then have to collect the items and queue all over again.

Now imagine that instead the cashier would say “Oh It’s okay. Just pay us next time you come in”. With a feeling of gratefulness and appreciation at this generosity, you would leave the supermarket with a relieved smile.

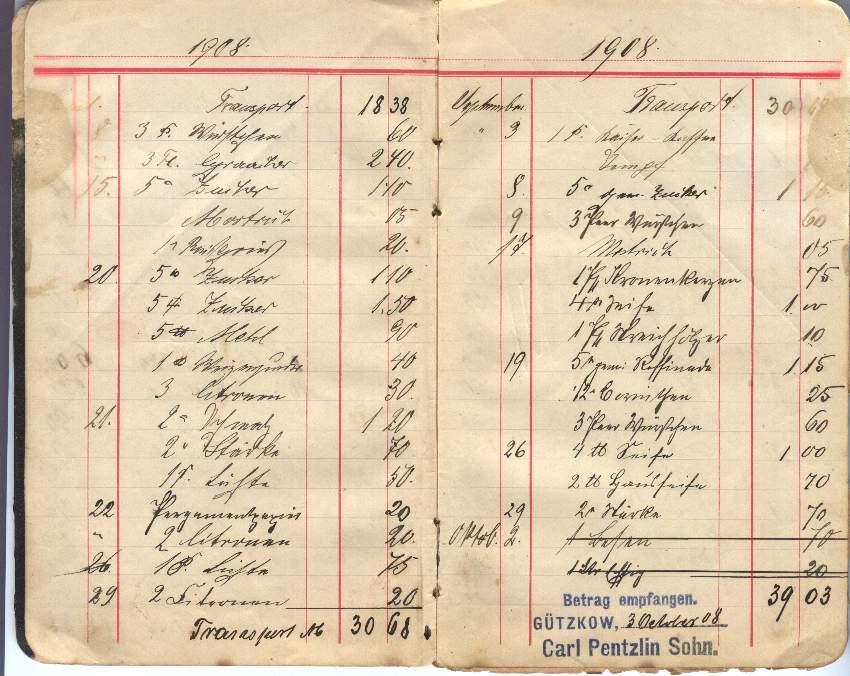

The concept of “Put it on my tab” is not a new one and has been with us for some time. Many years ago, the “tab” consisted of a physical tablet or notebook where all these open payments were written down. When I went shopping with my Mum as small boy, this was generally based on the “Put it on my tab” pattern. The pharmacy, the fruit and vegetable shop, the butcher all simply made a note and billed the “family account” at the end of the month. There was no written contract and my Mum was so used to this system that she seldom took money with her – and she always returned to the same shops.

Doesn’t the same happen to us nowadays with many relationship-based business partnerships? We use the mobile phone and get billed later. We use electricity and pay at the end of the month. We use car2go and are billed after usage. Not to forget the invention of the credit card which is based on the same principle. The difference of these examples and the „put it on my tab“ pattern is, that they make you sign a contract to ensure you will pay the bill and your credibility is checked before you are allowed to have that business relationship. „We don’t trust you“ is their initial message.

In the “Put it on my tab” pattern, future payment is ASSUMED and the risk for the lender of not getting paid is accepted. This is an impressive sign of trust and one which encourages us to return as loyal partners. It also imparts a feeling of owing more than just the money you did not pay immediately. You owe loyalty and trust. The pharmacist probably experienced some incidents of fraud, but overall this policy paid off.

In e-commerce there is of course no one-on-one relationship to handle the risk involved in the “Put it on my tab” pattern and there is no pharmacist who knows you personally, but there is real-time data which makes it at least as easy to predict fraud and control the overall sum of losses involved in applying the pattern (more on this in future posts).

Have you ever applied the “Put it on my tab” with friends?

Presumably you have!

Have you ever considered applying the “Put it on my tab” pattern in your customer relationship?

Recently there was an amount of minus 3 Euros in my PayPal account and I was not permitted to use the PayPal payment service until I transferred these 3 Euro from my bank into my PayPal account. As I have been using PayPal for about 15 years, one can imagine how this affected my feeling of loyalty towards them. I was so upset, that I opened a Paydirect account instead – knowing that it would not be as great a product.

Imagine buying at Otto.de for years and one day at the online checkout your credit card seems to be invalid. How would it feel, if Otto.de would say, “No problem! We are sending the item. Please transfer the money until end of the month”

Also published on Medium.